Six ESG Highlights for 2026

With 2026 in full swing, many people are working to get their plans for the year moving forward. For ...

Crude oil has consistently held a pivotal role in the global economy due to its indispensable function as a primary energy source, powering various modes of transportation, heating systems in households, and supporting numerous industrial processes. The direct correlation between oil prices and the economy is evident, as the cost of goods and services rises alongside increasing oil prices, given its role as an essential input in various sectors.

Analyzing the recent crude oil price movement, the average price of a barrel on June 26 was recorded at $69.37. Presently, on July 25, the average barrel price has exhibited an upward trend, reaching $78.79. This translates to a substantial 15.85% appreciation in value over the course of one month, equivalent to nearly half a percent increase daily. Consequently, oil companies have experienced heightened profitability, with an estimated conservative profit of $20 per barrel when the price hovers around $76.

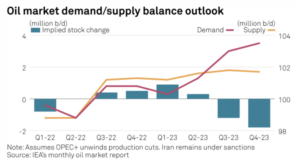

Considering these circumstances, the current market presents promising investment opportunities, particularly given the record profits witnessed in the oil industry in 2022. Furthermore, the ongoing rise in barrel prices, coupled with China’s continuous purchase of oil barrels, is projected to escalate global oil demand by approximately 2.2 million barrels per day. This expected surge in demand would result in an average daily sale of 102.1 million barrels, solidifying the prospects of a lucrative oil market. On top of this, OPEC has decided to cut down the production of oil by nearly 1.4 million barrels per day leading to rising oil prices.

With 2026 in full swing, many people are working to get their plans for the year moving forward. For ...

Generative AI has moved quickly from experimentation to production, but in financial services, ...

BridgeWise , the global leader in AI for investments, has today announced an international ...